Easily access all the tax info you need directly from your FreshBooks account, to ensure easy collection and filing this tax season,

If you own a small business, you may have anxiety when it comes to tax time. You’re not alone. We’ve all been there: Digging through mountains of receipts, triple-checking invoices from half a year ago, losing sleep over whether you chose the right category for your expenses. Even if you think you’ve covered all your bases, you’ve lost valuable time looking for information that you could retrieve in a few clicks.

To help, FreshBooks gives you access to all the data you need in 3 thorough Reports. The Profit & Loss Report, General Ledger Report, and Sales Tax Summary Report will save you time and spare you the stress of collecting and verifying everything you need to file your taxes with confidence.

- Profit & Loss Report

- HOW DO I ACCESS MY PROFIT & LOSS REPORT?

- General Ledger Report

- HOW DO I ACCESS MY GENERAL LEDGER REPORT?

- Sales Tax Summary Report

- HOW DO I ACCESS MY SALES TAX SUMMARY REPORT?

- Other Reports to Consider at Tax Time

- Need Help Getting Started?

- How a Relationship Coach Uses FreshBooks to Make Tax Time a Breeze (VIDEO)

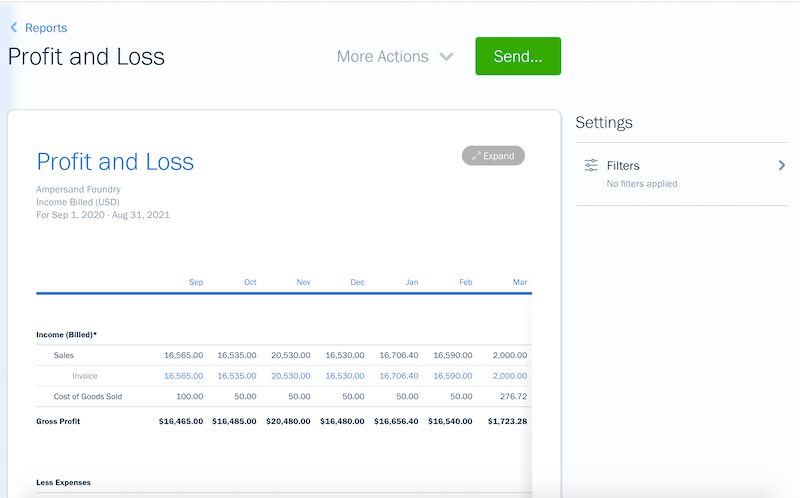

Profit & Loss Report

Your Profit & Loss Report (a.k.a. P&L) shows your total Income and Expenses in a specific period of time to give you a net profit or loss. This is an essential Report come tax time, as it contains the information you’ll need to report on for your tax returns. Think of it as a snapshot of your business activity over the last year.

A P&L statement is important as it’s one of the three types of financial statements prepared by you or your accountant/accounting software to tell the financial story of your company. The other two are the balance sheet and the cash flow statement. The purpose of the P&L statement is to show company revenues and expenditures over a specified period of time, usually over one fiscal year.

As a business owner, you and your accountant can use this information to understand the profitability of the company, often combining this information with insights from the other two financial statements.

For example, you may want to calculate a company’s return on equity (ROE) by comparing its net income (as shown on the P&L) to its level of shareholder’s equity (as shown on the balance sheet).

HOW DO I ACCESS MY PROFIT & LOSS REPORT?

Accessing your profit and loss report in FreshBooks is easy! To run your report:

- Go to the Reports section of your account

- Select Profit & Loss under Accounting Reports

Here’s what it looks like in FreshBooks:

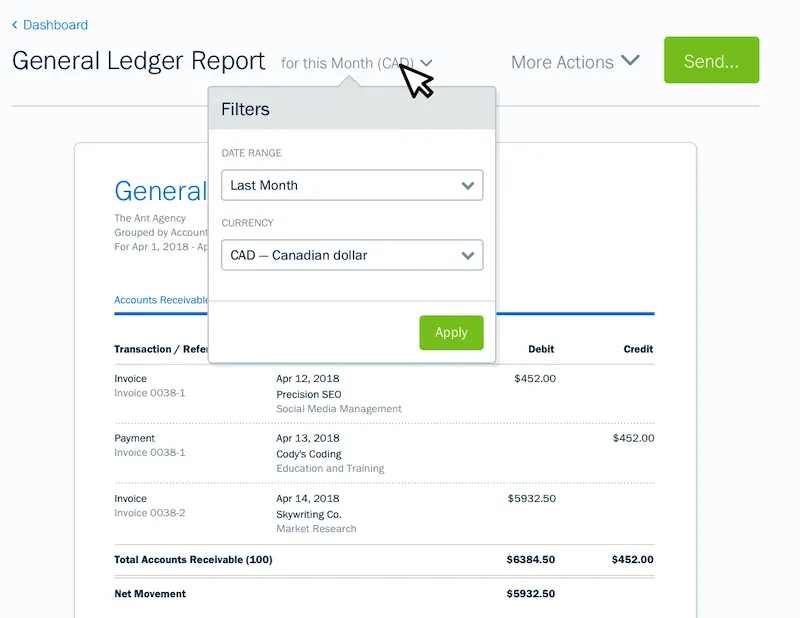

General Ledger Report

The General Ledger Report gives you a detailed list of all the transactions you have in your account for a selected timeframe. It’s an invaluable tool that makes sure you’ve categorized everything correctly and you’re not missing any potential tax deductions.

HOW DO I ACCESS MY GENERAL LEDGER REPORT?

To run your General Ledger Report:

- Go to the Reports section of your account

- Select General Ledger Report under Accounting Reports

Here’s what it looks like in FreshBooks:

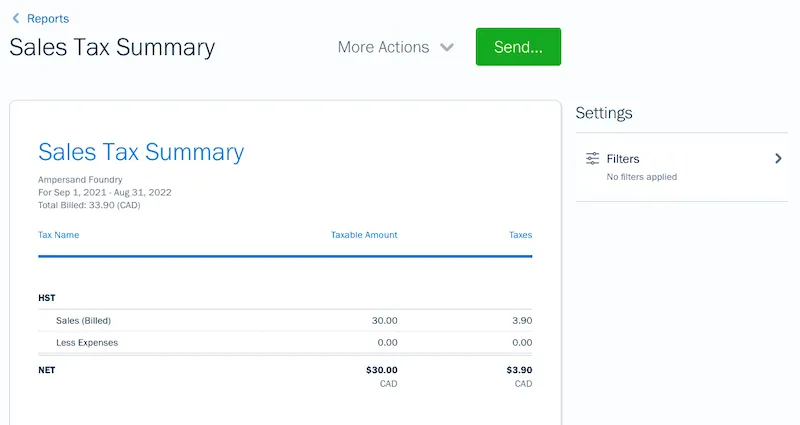

Sales Tax Summary Report

The Sales Tax Summary Report gives you a breakdown of the sales tax you’ve collected on revenue, along with how much you have paid on Expenses. If you are registered to collect Federal or Provincial sales tax, this will neatly summarize the information you need to file your sales tax returns.

HOW DO I ACCESS MY SALES TAX SUMMARY REPORT?

To run your Sales Tax Summary Report:

- Go to the Reports section of your account

- Select Sales Tax Summary under Accounting Reports

Here’s what it looks like in FreshBooks:

Other Reports to Consider at Tax Time

The 2 other Reports worth looking at are the Cash Flow Report which breaks down exactly how much cash you have on hand, as well as where the money came in from and went to, and the Invoice Details Report, which provides a detailed summary of all the invoices you created and sent over a period of time.

Need Help Getting Started?

If you have any questions about these Reports, a team of Support Rockstars is ready to help you out. Contact them here.

This post was updated in February 2022.

How a Relationship Coach Uses FreshBooks to Make Tax Time a Breeze (VIDEO)

about the author

Dave is a Senior Copywriter currently working for FreshBooks, serving all the amazing businesses using the platform. When he’s not writing, Dave can likely be found binging Netflix alongside his dog Indy.

An Easy Solution to Organized U.S. Taxes: Business Expense Categories

An Easy Solution to Organized U.S. Taxes: Business Expense Categories Why the Cloud Is Your Ally at Tax Time—and Beyond

Why the Cloud Is Your Ally at Tax Time—and Beyond Partners to Help You Prepare for Tax Season

Partners to Help You Prepare for Tax Season