The right way to do job costing for service-based businesses.

Did you know that 50% of small enterprises fail within the first year?

While many factors contribute to the rise or fall of a business, there are ways to alleviate risk. One of those ways is to have clear visibility into the profitability of your business. This allows you to identify areas of improvement, and determine which projects have been yielding optimal results.

So how can you avoid becoming a statistic, increase visibility, and grow your profitability?

The answer: job order costing.

Now, let’s dive deeper into the details of job order costing and how to implement it into your business.

- What is Job Order Costing?

- Direct Labor Costs

- Direct Materials Costs

- Overhead Costs

- It Determines the Profitability of the Job

- It Allows You to Make Data-Driven Decisions

- It Is a Scalable Solution as Your Company Grows

- Job Order Costing for Service Businesses

- Example 1: Marketing Agencies

- Example 2: Film and Production Studios

- Example 3: Law Firms

- Time Tracking + Job Order Costing

- Project Profitability Tools + Job Order Costing

- How Job Order Costing Can Go Wrong

- Bottom Line: Job Order Costing Is Essential for Profitability

What is Job Order Costing?

Job order costing is a system that specifically tracks costs and revenue for individual projects. (It’s also called job costing, project accounting, or project-based accounting.)

With job order costing, each project is broken down into three areas: labor, materials, and overhead. It’s essential to understand the direct and indirect costs associated with each.

In simplest terms, the total job or project cost is the sum of the direct labor, direct materials, and overhead costs. (Learn more about how to calculate job order costing for small businesses.)

Direct Labor Costs

Staff members who work to execute a specific product or project constitute your direct labor cost. Don’t forget to calculate costs incurred for your own labor here! The final cost will include wages and salaries as well as training, tax contributions, and benefits.

You may also have indirect labor costs. These are included in your overhead cost.

Direct Materials Costs

A direct material is a physical material that constitutes an “ingredient” to make a specific product for the business. For example, if you are a furniture maker, wood is a direct material. Direct materials can be tracked against particular product(s) on a bill of materials or materials requisition form.

If you are a service-based business, your direct material costs might be $0. The physical materials needed to support the execution of services (such as paper, printer ink, or a laptop) are indirect materials and are considered overhead costs.

Overhead Costs

Overhead refers to ongoing costs that aren’t tied to a specific service or product produced but are essential to execute those services or products. Examples are rent or utilities for office space, shipping costs, and the indirect materials mentioned above.

Depending on the type of business you run, you may have manufacturing overhead or service overhead.

While some overhead costs are fixed (like rent) others are variable (like shipping) or semi-variable (utilities). This variability can make overhead challenging to calculate exact overhead.

Instead, many businesses use a fixed fee for applied overhead on each project. You can calculate a predetermined overhead rate using this formula:

Predetermined Overhead Rate = Estimated Overhead / Estimated Activity

To calculate an accurate estimate of your overhead costs, list all expenses that do not contribute to generating revenue. Items such as rent, utilities, building maintenance, etc., should be included in this calculation. Once this is complete, you’re ready to determine the estimated activity.

Calculating estimated activity is done by adding the activities that apply to overhead costs, such as labor hours. Learn more about calculating your overhead costs.

Job order costing matters for businesses that must optimize their costs when pressures such as increased competition, limited time to complete projects, and limited labor come into play. Here are three ways this method can help your business:

It Determines the Profitability of the Job

When done right, job order costing can identify opportunities with the highest profit potential and drive your business to those high-paying opportunities — boosting profits and scaling your business. Determining the estimates for labor, materials, and overhead costs ahead of time will allow you to decide whether to take on a project.

It Allows You to Make Data-Driven Decisions

Using job order costing over time will develop a historical record of all projects you’ve completed. This information can be revisited monthly, quarterly, and yearly to evaluate the company’s efficiency and identify areas to reduce costs.

It Is a Scalable Solution as Your Company Grows

Implementing processes and technology that scales with your company as it grows helps you focus on, well growing your business. The job order costing method stays the same no matter the changes your company makes as it grows.

Job Order Costing for Service Businesses

Job order costing is often presented as a tool for product-based businesses. But it also applies if you are service-based. Costs typically break down differently, though, with labor being very important and materials not as much.

Key differences if you offer services rather than products are:

- Specific tracking and inventory for materials is not likely needed

- In some jobs, like accountancy, labor may be the only direct cost

- Because labor is most important, employees use a timesheet or time tracking system to record the amount of time spent working on a job

Let’s dive into some examples of job order costing for service-based businesses:

Example 1: Marketing Agencies

Let’s say you own a marketing agency and a client hires you to write copy for a landing page. They’ve already provided an outline, web page design, quotes, and stats.

Now let’s say another client comes along and wants a similar landing page copy. But they want you to interview 5 subject matter experts, present the findings and propose the direction and copy of the landing page.

The same type of copy, two completely different projects. Using job order costing to determine the profitability of each project gives you valuable insight into the value of each client and can help you package and price your services.

Example 2: Film and Production Studios

In film and production industries, job order costing is used to track labor and material costs such as props, costumes, actors, and camera equipment.

Depending on the project’s budget and requirements, job order costing becomes extremely useful when determining where to cut costs and profitability margins.

Example 3: Law Firms

A corporate lawyer can work with a client to provide basic legal advice for a case that doesn’t require extensive legal research, meetings, or resources. If the same lawyer worked on a complex case that required hours of research, meetings, and additional resources, they would use job-order costing to calculate the exact amount the client owes for the direct labor and direct materials used to complete the service.

Time Tracking + Job Order Costing

In service-based businesses, where direct labor is the most substantial cost, time tracking based on predetermined rates is essential for successfully implementing a job order costing system. It demonstrates whether a project is worth the time you spent on it and identifies whether you undercharged based on the time it took to complete.

Time tracking can be done using spreadsheets or good old-fashioned pen and paper. But having time-tracking software is a more efficient and scalable solution that provides clear visibility into how employees are spending their time.

👉 Tip: look for time-tracking software (such as FreshBooks) that integrates with your tech stack for accounting, invoicing, project management, and payroll.

Project Profitability Tools + Job Order Costing

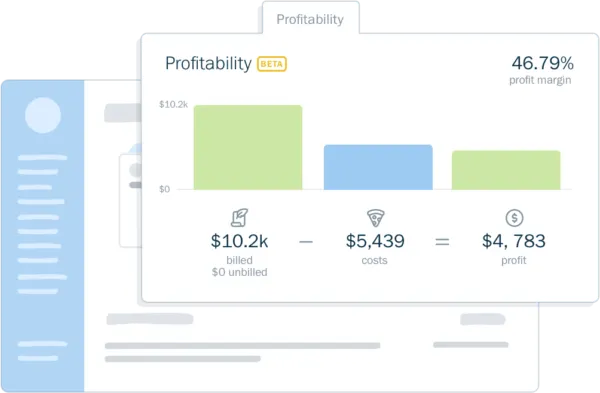

Using project profitability and job order costing together is the perfect combination for running a business. First, job order costing details each expense, estimating costs in an accurate manner. Then follows project profitability tools, which track the performance of projects to determine exactly how profitable they are.

FreshBooks Project Profitability reporting tool collects all your costs from your income and provides a visual breakdown of each, so you can clearly determine which projects are profitable.

How Job Order Costing Can Go Wrong

While there are many benefits to job order costing, this method can go downhill quickly if it’s not implemented correctly.

The key to job order costing success is precise documentation on your direct materials, overhead costs, and direct labor hours that contributed to completing a project. You’ll need to ensure these are as accurate as possible to strike a balance between revenue and project costs.

This is why it’s crucial to have an adequate costing system in place that tracks each of these variables involved in job order costing. Time-tracking and project profitability tools, as mentioned above, ensure that you’re accounting for all details needed.

If you fail to account for your business costs accurately, then you aren’t building a firm foundation for decision-making. In turn, the many benefits of job order costing such as increasing profitability and visibility aren’t experienced.

Bottom Line: Job Order Costing Is Essential for Profitability

Gaining clear visibility into your business is essential to grow profits and build a scaling company. While it’s easy to feel overwhelmed running a business, we can draw out a few main points of job order costing to keep in mind:

- Because job order costing breaks down each expense (labor, materials, and overhead), it determines the profitability of a project and informs you if it’s worth pursuing

- Over time, job order costing can provide valuable data regarding projects which can inform business decisions

- The job order costing method adapts to any project and can be used as your company grows

- Accurate employee time tracking is essential when implementing a job order costing system and software that calculates and automates some of this process diminishes room for error

about the author

Megan Smith is a B2B marketer based in Toronto with experience in SaaS, e-commerce, and fin-tech industries. Megan creates content that educates, inspires, and drives revenue.

How Time Tracking Can Kickstart Your Business Growth

How Time Tracking Can Kickstart Your Business Growth What Is Working Capital? Here’s Everything You Need to Know

What Is Working Capital? Here’s Everything You Need to Know Easily Track Every Project’s Performance

Easily Track Every Project’s Performance