Gain more control over your books with the customizable Chart of Accounts.

Let’s say your business is growing… Maybe you’ve just moved up from being a freelancer to starting your own agency. First off, congratulations! But with that growth comes certain challenges. Like, staying on top of your client relationships. Or having access to the right reports at the right times. Or even, bringing in an accountant to help you keep on top of every number.

And as you navigate your growth, you may find you need more flexibility with how you track your numbers. This includes tailoring your Chart of Accounts to create insightful Reports. Keeping an eye on all parts of your business means you can grow your business mindfully, with thorough knowledge of loans, new assets, or unique expense categories.

To help, we’ve launched the customizable Chart of Accounts [beta]. It gives you and your accountant more control over your Accounts and Subcategories, so you can customize and scale them as your business continues to grow.

What Is the Customizable Chart of Accounts?

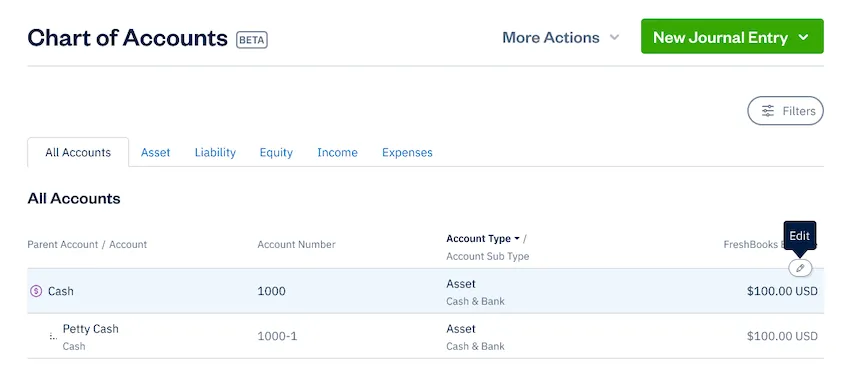

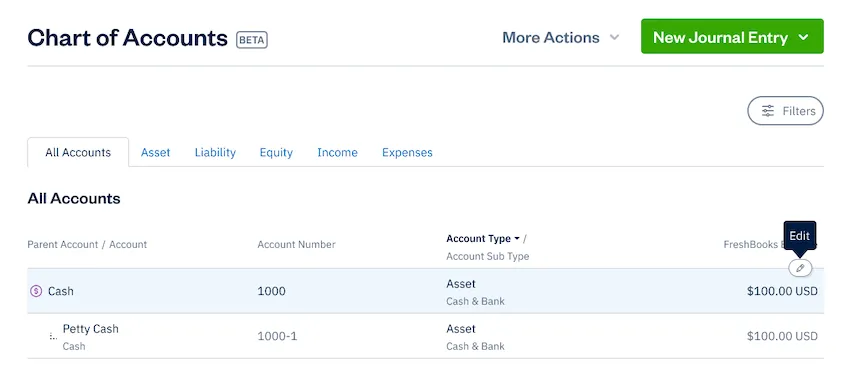

The Chart of Accounts (CoA) lists all the Accounts your business records in your General Ledger. The customizable Chart of Accounts allows you to add, edit, and archive Accounts to make it easier to see what’s going on in your business.

How Does the Customizable Chart of Accounts Work?

As you deposit payments, record bills, or send invoices to customers, you record the transaction in your General Ledger using the Accounts found in the Chart of Accounts.

Your Chart of Accounts comes with default Accounts, including the following:

- Asset Accounts

- Liability Accounts

- Equity Accounts

- Revenue Accounts

- Expense Accounts*

*Expense Accounts are the same as Expense Categories.

**You can find the default Accounts in your Chart of Accounts by doing the following:

- From the blue navigation bar on the left inside your Account, click on the Accounting section.

- Then click on the Chart of Accounts sub-tab underneath Accounting.

How Do I Edit My Chart of Accounts?

The customizable Chart of Accounts is available on Plus, Premium, and Select FreshBooks plans. If you’re not on one of these plans, but want the customizable Chart of Accounts, you can easily and quickly upgrade your plan here.

Getting started with the customizable Chart of Accounts is easy! Below you’ll find steps on adding Accounts, editing Accounts, and archiving Accounts.

Turn on Advanced Accounting

- Log into your FreshBooks account

- Click the gear icon and then click on Settings

- Navigate to the Accounting tab

- Toggle on the Turn on/off Advanced Accounting toggle

To Add an Account

As your business grows, you may decide you need additional Accounts to extract more information from your Reports. To add an account:

- Log into FreshBooks and click Accounting from the left navigation bar

- Scroll to the bottom of the page and click on Chart of Accounts or click on Accounting on the bottom left navigation and then click on Chart of Accounts underneath

- Click on More Actions and add New Account

- Select Account Type and account Sub Type

- Enter an Account Name and edit the Account Number, if desired. You can also include a description to clarify what this Account will be used for if you want.

To Edit an Account

As your business changes or grows, you may decide your Account isn’t as accurate as you’d like. To edit your Account:

- Click the pencil icon on an Account line

- Change the Account Type, Account Sub Type, whether the Account is a Parent Account or a Sub Account, and edit the Account Name and Account Number.

Note: When changing the Account Type or Account Sub Type of a Parent Account, all Sub Accounts (including Archived Accounts) under this Parent Account must be removed. Additionally, you cannot edit some Accounts as they are locked because they are required for automated transactions.

To Archive an Account:

As your business evolves, grows, or changes, you may not need all of your Accounts. You can easily archive Accounts you no longer use by doing the following:

- Navigate to the Account you’d like to archive

- Click the Archive button

- Check off every box in the warning modal to confirm you understand the consequences of archiving the Account

*Note: All Sub Accounts will also automatically be archived when archiving Parent Accounts.

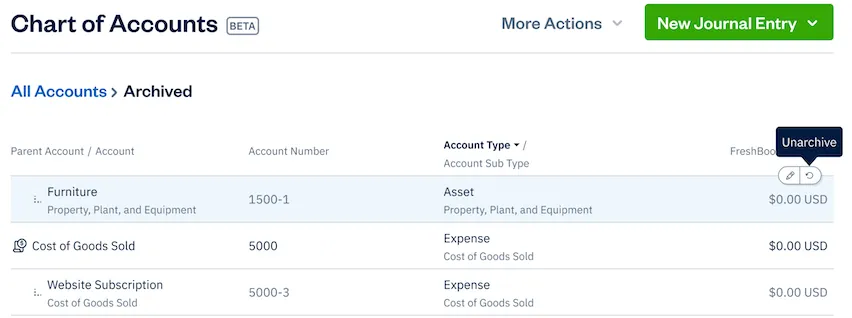

To Unarchive an Account:

In the same vein as above, if you once again want to use an account that was previously archived, simply follow these steps:

- Navigate to the bottom of the Chart of Accounts

- Click on View All Archived Accounts

- Find the Account you wish to unarchive and click the Unarchive button

This account will reappear in the Chart of Accounts and you can start re-assigning transactions to it.

Can I Change the Chart of Accounts to Include Whatever Sub-Categories I Want?

You can… but we recommend keeping it organized to comply with standardized financial reporting. The Categories suggested are tied to tax categories that make tax time easier. If you’re unsure, speak to your accountant or bookkeeper to help you set up the right Subcategories. If you don’t have an accountant or bookkeeper, we can help you find one who can work with you and your business.

Why Should I Use a Customized Chart of Accounts?

You may find the pre-populated Chart of Accounts gives you the perfect amount of information you need to run your business and make informed decisions. Which is great! That’s how we have designed the Chart of Accounts, so you can get started in FreshBooks right away.

However, as your business grows, you may need the flexibility of a more tailored approach to your accounting (although this is definitely not required!). Your accountant may want to adjust your categories and subcategories to help you grow your business. Maybe you want to create more insightful reports, so you always know where you stand. Or it might be that you want to be 100% confident your Reports (like the Balance Sheet and Profit & Loss Statement) are ready for tax time.

Whatever your needs, the customized Chart of Accounts can help you manage your accounting.

If You Need Help, FreshBooks Is Here

If you have any questions about this feature, don’t hesitate to contact our support team here!

about the author

Patti is a Copywriter at FreshBooks, where she works on incredible projects helping serve the FreshBooks community.

4 Reasons You Should Track Your Business Expenses Daily

4 Reasons You Should Track Your Business Expenses Daily 7 Types of Business Relationships You Need to Grow Your Small Business

7 Types of Business Relationships You Need to Grow Your Small Business The 5 Most Important Profitability Ratios You Need for Your Small Business

The 5 Most Important Profitability Ratios You Need for Your Small Business