Get Started With

Payroll in Minutes

Gusto monthly plans start at $40 + $6/per person.

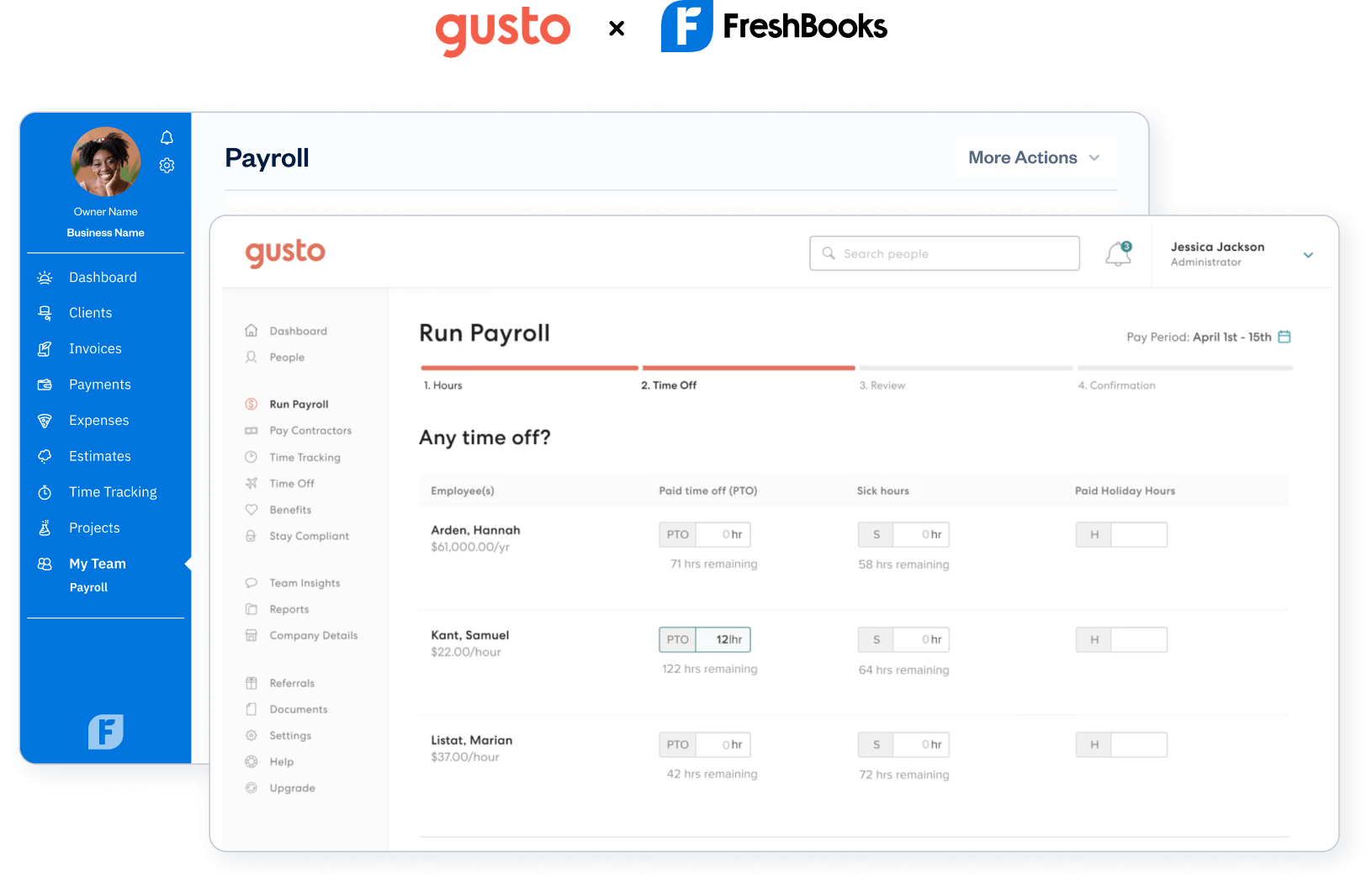

GUSTO SEAMLESSLY INTEGRATES WITH FRESHBOOKS TO MAKE PAYROLL EASY

of customers say Gusto is easier to use than their last payroll provider.

to run payroll on average, as reported by customers.

of customers say switching to Gusto is easy.

Fast. Easy. Payroll.

Gusto is an easy-to-use payroll solution designed for small businesses that seamlessly integrates with FreshBooks. They provide unlimited payrolls, automatic tax filings and payments, direct deposit, plus so much more.

Or Learn More

Get Started in Minutes

Gusto fully integrates with FreshBooks through a quick and easy setup. And if you need help, you can get step-by-step support so you’re never in the dark.

Focus On Work, Not Paperwork

Get access to unlimited payrolls, automatic tax payments and filings, direct deposit, W-2s and 1099s. Plus, FreshBooks automatically pulls every payroll transaction into your account as an expense.

Automatic Payroll Tax Filing

Gusto not only calculates your taxes, they automatically file them with the right government agencies every time you run payroll.

Easier Onboarding

Use your FreshBooks data to help create your Gusto account in no time

Expense Sync

Import Payroll Runs to be automatically categorized as Expenses

Pay Run Information

Get an at-a-glance summary of both your previous payroll run and your upcoming pay periods

HR Tools

Access to online HR tools, documents, and other live HR advice within Gusto (only available with certain plans

Choose the Best Payroll Provider for Your Business

FreshBooks integrates with multiple payroll providers that give you the capabilities of an entire finance team. Just sync to their platform, and stay compliant with taxes, pay your employees, and maintain accurate books.

Have Lots of Clients and Want to Save on Billing?

Our FreshBooks Select Plan could be the solution for you, saving you time and money.

The Select Plan includes:

- A dedicated account manager to train your team and migrate your books from other platforms

- Access to lower credit card fees and transaction rates

- 2 free team member accounts

Some Extra Reading on How Payroll Can Help Your Business

Get a newsletter that helps you think differently about your business

Frequently Asked Questions

Does FreshBooks Offer Payroll?

FreshBooks has partnered with Gusto, the leading SMB payroll solution in the US, to help owners run payroll. After setting up, you can run your team’s payroll on Gusto (in ~10 minutes). And then the transactions are automatically imported and categorized directly in FreshBooks – making it fast and easy to track every payday.

How Does Payroll Work?

Connect and sync FreshBooks to Gusto, and you’ll get access to the capabilities of an entire finance team. Within Gusto, you can run your payroll, track and review expenses, and then complete a pay run. Once complete, you will see the transactions recorded as expenses in FreshBooks. Also, Gusto helps you stay compliant with taxes, maintain accurate books and simplify one of the most confusing parts of your business. You’ll save yourself time, money, and likely, a few headaches too.

What’s the Difference Between Contractor & Employee Payroll?

In general, an employee:

- Works at a specific time and place set by you, the employer

- Generally works for just one company

- May receive training

- Uses your tools or other work-related resource

- Does work that is an integral part of your business

- Is subject to a large degree of control by you

- Is generally paid a salary or hourly wage

In general, a contractor :

- Can work whenever and sometimes wherever they’d like

- Can work for multiple companies

- Usually trains on their own

- Uses their own tools and resources

- Controls their own method of work

- Is often (but not always) paid by the project or on a flat-fee basis

And as a result, there are different tax implications for each type of worker, and so categorizing them properly is important. Thankfully, Gusto helps you navigate all this, but if you want a more in-depth breakdown you can

Does FreshBooks Allow for Teams to Collaborate?

FreshBooks is designed for both small business owners just starting out, and teams that are continuing to grow. You can keep your team on track with easy-to-use timesheets, expense tracking, and payroll integrations. You can invite your Team Members as one of 5 user roles: Admin, Employee, Contractor or Accountant. You can also customize these roles further with Client Access and Project Manager settings.

How Can You Pay Yourself as an Owner?

Paying yourself is an important part and consideration of running a small business. The Gusto payroll integration on FreshBooks helps you pay yourself easily. To get started:

1. Determine Your Business Type

Deciding on your business entity will help set the foundation for the entire payroll process, and will help point you to the payment style that’s right for you.

2. Figure Out the Best Payment Method

Now, think about how you’d actually like to pay yourself:

A. Owner’s Draw

This allows you, as the owner of the business, to withdraw money from your business for personal use.

B. Salary

Salaries are set, recurring payments that are taxed by the state and federal governments.

3. Select an Amount

Once you’ve determined the right method, you need to calculate how much to give yourself. Here’s a handy guide to help: how much to pay yourself.

4.Pick a Payroll Schedule

If your business has at least one employee (including yourself!), you need to think about how often you want to pay yourself (e.g. bi-weekly, monthly, etc.)

5. Get Your Paycheck

Getting paid can be as easy as writing a check and depositing it into your personal bank account, or using direct deposit.

And that’s it! For a more detailed breakdown, Gusto has written this article.

How Do I Connect Payroll to FreshBooks?

You can follow the steps listed here. Or:

1. From your FreshBooks dashboard, select the Settings menu in the top left corner of the navigation pane.

2. In the Settings fly-out, select Payroll.

3. Sign up for a free Gusto trial to get started, or connect an existing Gusto account.

4. Set-up the FreshBooks integration by logging into Gusto and clicking on the App Directory from the left-navigation menu.

5. Search for FreshBooks by either typing “FreshBooks” in the search field or click on Popular and then click on FreshBooks

6. Click on Connect if you have an existing FreshBooks account or click on Create Account if you want to set up a FreshBooks account.

7. In the Connecting to FreshBooks pop-up window choose “my.freshbooks.com” and click Connect.

8. Authorize Gusto to connect to your FreshBooks account.

9. If you have more than one account, choose the preferred account and click Connect to FreshBooks.

10. On the Payroll page in FreshBooks, you’ll be able to see that the integration is connected once setup is successfully completed.

How Is Payroll Reflected in My Books on FreshBooks?

Gusto integrates with FreshBooks to bring you payroll, W-2s, 1099s, payroll runs, and direct deposits. The Gusto integration allows you to automatically import Payroll Runs as categorized Expenses and view your Payroll Runs from within your FreshBooks account.

How Can I Calculate Payroll Taxes?

Every time you run payroll, Gusto calculates and files your taxes with the right government agencies for you.