What Is an Expense Report? (And Why They’re Important for Small Businesses)

An expense report is a form that itemizes expenses necessary to the functioning of a business. A small business may ask its employees to submit expense reports to reimburse them for business-related purchases such as gas or meals. Or a small business owner can use expense reports to track project spending and get organized for tax time.

In this article, we’ll cover:

What Is an Expense Report?

An expense report is a form that tracks business spending. An expense report form includes any purchases that are necessary to run a business, such as parking, meals, gas or hotels, according to Entrepreneur.

An expense report can be prepared using accounting software or using a template in Word, Excel, PDF and other popular programs.

What an Expense Report Looks Like

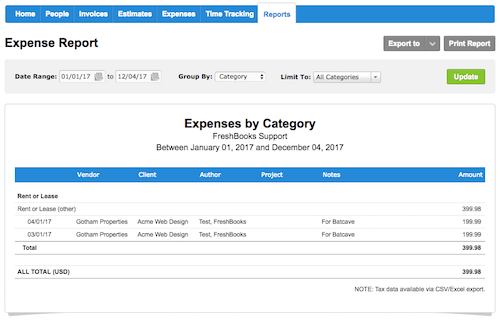

An expense report typically has columns such as:

- Date: the date the item was purchased

- Vendor: where the item was purchased

- Client: what client the item was purchased for

- Project: what project the item was purchased for

- Account: instead of client or project fields, an account number can be used

- Author: who purchased the item

- Notes: additional clarifying notes

- Amount: total cost of the expense, including tax

Below is a basic example of an expense report. This report generates expenses according to tax category, like rent (we’ll cover this below). There’s a subtotal per category and then a grand total. Create an expense report according to a date range, export it to Excel or print it.

Source: FreshBooks

Expense tracking software from FreshBooks makes it easy to prepare your taxes, bill clients for expenses and track project spending without tons of manual input.

What an Expense Report Is Used For

Small businesses with employees who often pay out-of-pocket for business expenses need to submit expense reports.

The employee’s expense report will itemize all their reimbursable expenses. They should also attach receipts to the expense report. The owner can then review the expense report for accuracy and reimburse the employee for the total.

A small business owner can also use expense reports to review their total expenses over a particular reporting period--usually a month, quarter or year. The owner can see if total expenses were more or less than expected and analyze the results, according to Accounting Tools.

Business Expense Categories

Taxes are another big reason small businesses need to use expense reports. Many business expenses can be written off in a company’s taxes. This article covers all the most common deductible expenses for freelancers, the self employed, sole proprietors, contractors and more.

Deductible business expenses include travel costs, rent, insurance, interest on business loans and car expenses, according to the IRS.

Generating an expense report helps you (or your accountant) easily add up all expenses so they can be input into tax forms. The IRS has standard categories they use in their forms. You enter your total expenses per category.

- For example, a sole proprietor would use Schedule C in addition to their personal tax return form. If they had $1000 worth of advertising expenses, they’d enter $1000 in the advertising line.

It is important to use the IRS’ categories in your expense reports. This will help you do your taxes faster.

Schedule C lists categories such as the following:

- Advertising

- Car and truck expenses

- Commissions and fees

- Contract labor

- Employee benefit programs

- Insurance

- Interest

- Mortgage

- Legal and professional services

- Office expenses

- Pensions and profit-sharing plans

- Rent or lease

- Repairs and maintenance

- Taxes and licenses

- Travel and meals

- Utilities

- Wages

People also ask:

What Is a Monthly Expense Report?

Expense reports are usually generated on a monthly, quarterly or yearly basis. A monthly expense report shows all the purchases a company makes during a month that are essential to running a business.

A yearly expense report is often used to write off expenses on a business’s taxes. So a monthly expense report would be used for other purposes, like checking whether a company is spending within its budget. In times of financial difficulty, a monthly expense report can be used to check how costs can be cut or eliminated to improve profit.

An employee can also submit a monthly expense sheet that logs all their business-related purchases over a month. The necessary receipt or receipts should be attached.

Their boss can then review the report for accuracy and legitimacy and either submit a reimbursement to the employee if they paid out of pocket or use the report to track project spending, according to Business Dictionary.

This article has a step-by-step guide that teaches small businesses how to do an expense report, monthly or otherwise.

What Is Considered an Expense?

An expense is money a company or self-employed individual spends in the course of running a business or carrying out a trade in an effort to make a profit.

These can include payments for wages, travel costs or rent. It can also include a decrease in value of assets (items owned) i.e. depreciation.

- For example, a company vehicle depreciates in value and this is considered an expense.

Finally, amounts deducted from earnings are also considered an expense.

- For example, a bad debt (money a business can’t collect from a client) is an expense.

All expenses are costs. That said, not all costs are expenses.

- For example, new cooking equipment is purchased for a soap-making business. This cost isn’t an expense as it was bought to generate more income.

Expenses are summarized on a company’s income statement and can be itemized on an expense report, according to Business Dictionary.

This article looks in-depths at the types of expenses small businesses typically have.

Expense Report Templates

Expense report templates are a quick solution to tracking expenses. That said, you will eventually want to upgrade to expense-tracking software that saves time, especially as your number of expenses grows with your business.

- Microsoft Office has a free downloadable expense report template for Excel

- This mileage log for Excel helps you track and get reimbursed for your mileage

- This simple printable expense report template tracks and adds up your travel expenses

- A simple expense report template for Word and PDF

RELATED ARTICLES