Financial Reporting Software To Help Your Business Grow

As a business owner, you need financial reporting tools that show you how your business is performing. From a simple dashboard to robust reports, the FreshBooks financial reporting software always keeps your business performance transparent to you, your business managers, and your accountant.

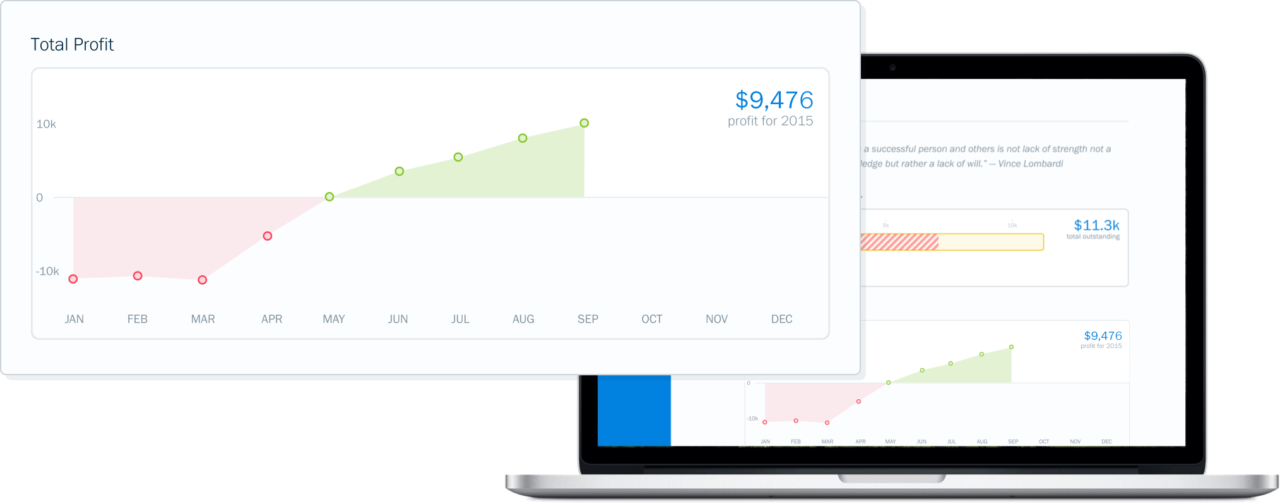

The Dashboard, Your Daily Answer to “How’s Business?”

With a high-level snapshot of your financial data, the Reports Dashboard on the FreshBooks financial reporting software helps companies track spend, revenue, and profit. With our effective business intelligence software solutions, you’ll know which clients need invoicing and see unbilled revenue you’re missing out on.

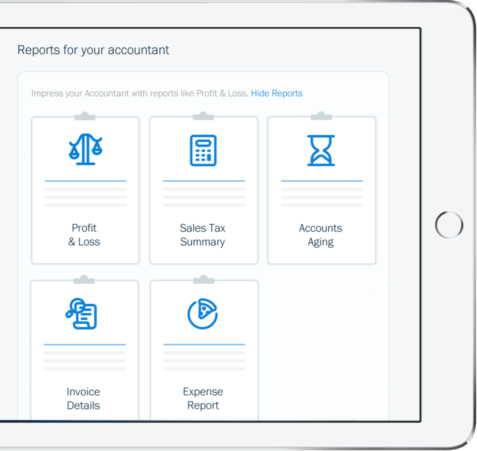

Ready-Made Financial Reports When You Need Them

Key features in the FreshBooks financial reporting software makes it easy to access critical business performance and financial reports (like your Profit and Loss and Expense Report), saving you time on basic accounting tasks and taking the stress out of tax season.

Confidently Tackle Tax Time

With the FreshBooks financial reporting software, small business owners can always be confident when tax time rolls around. From the money you’ve collected to the taxes you’ve already paid and everything in between, find all your tax management financial data in one place.

A Dashboard + Reports to Keep You On Track

Compared to other financial reporting software solutions, FreshBooks combines powerful cloud accounting software with easy-to-understand business performance reports and in-depth analysis of accurate data to help you keep track of all your business transactions and improve your cash flow forecasting:

- Colour-coded breakdown of spending

- Summary of most recent activity

- Profit and Loss Report

- Sales Tax Summary Report

- Accounts Aging Report

- Payments Collected Report

- Accounting Reports (General Ledger, Trial Balance, Balance Sheet, Bank Reconciliation)

- Expense Report

- Invoice Details Report

- Report filtering by client, team member, or date

- Save, export or print financial reports for your accountant

- Time Tracking and Project Profitability reports

See other ways the FreshBooks financial reporting software delivers powerful business insights >

Did You Know…

why it’s accounting software for businesses with contractors

Award-Winning Customer Support

Help From Start to Finish: Our Support team is highly knowledgeable and never transfers you to another department.

4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews.

Global Support: We’ve got over 100 Support staff working worldwide.

Book a Demo: Sign up for a live weekly FreshBooks accounting software demo and Q&A.

Frequently Asked Questions

Can I generate profit & loss reports in FreshBooks accounting software?

Absolutely. The FreshBooks financial reporting software enables small and mid-sized businesses and their finance teams to keep a close eye on their bottom line and manage expenses, thanks to Profit & Loss Reports (also known as income statements) you can whip up in seconds. An income statement, or Profit & Loss Report, is one of the three crucial financial reports used to track a company’s financial status, performance, and results over a specific accounting period. The other two key financial statements are the Balance Sheet and the Cash Flow Report.

You can run a Profit & Loss report for any time range by going to the Reports section of your account and selecting “Profit & Loss” under “Accounting Reports”. Your Profit & Loss report will be broken into several sections to make income and expense tracking easier. The “Income” section is broken down by Sales, Other Income, and Cost of Goods Sold. The “Expenses” section will display all of your Expenses during your selected date range. The “Net Profit” section will show your income minus your expenses to give you a total amount earned.

Want to grow your business and reach your business goals even faster? Check out this free eBook: Unlock Your Growth Potential with Working Capital.

Get a quick review of generating reports in FreshBooks with this short video.

I need to know where I stand with my clients. Does FreshBooks have a financial report or statement that shows me that?

Yes! The Client Statement report gives you key information like outstanding balances, Invoices and Payments history, and available Credits. Understanding client behaviours is an essential part of financial reporting, while a proper analysis of your books is necessary for both financial reporting and business decision making.

You can run an Account Statement for a client by going to the “Clients” section of your FreshBooks account and then clicking on the client you would like to run a statement for. You can then select “More Actions” and click on “Generate Statement” to get your Client Statement report.

While not a typical financial statement, once you’ve generated your Client Statement for your preferred date range, you can send the report to your client, export it to Excel, or print it.

Looking for more? Read this helpful article on financial statements: Financial Reports: The Most Important Numbers to Grow Your Business.

How can I see, at-a-glance, all the time my team and I have tracked?

Your financial reporting solution isn’t complete without the Time Entry Details Report. It shows you all the time you and your team (including contractors) have tracked over a specified period, along with the relevant financial data, in a new and improved way. You can customise this report to show you a particular range of time entries, along with their notes, using optional filters.

You can run a Time Entry Details Report in the Reports section of your FreshBooks account by clicking on Time Entry Details under Time Tracking Reports. Once you’ve run your report, you can adjust your view through several filters: Date Range, Group, Client, Currency, and Amount.

Once you’ve adjusted your report to a view that makes the most sense for you, you can then export your report to Excel or print it.

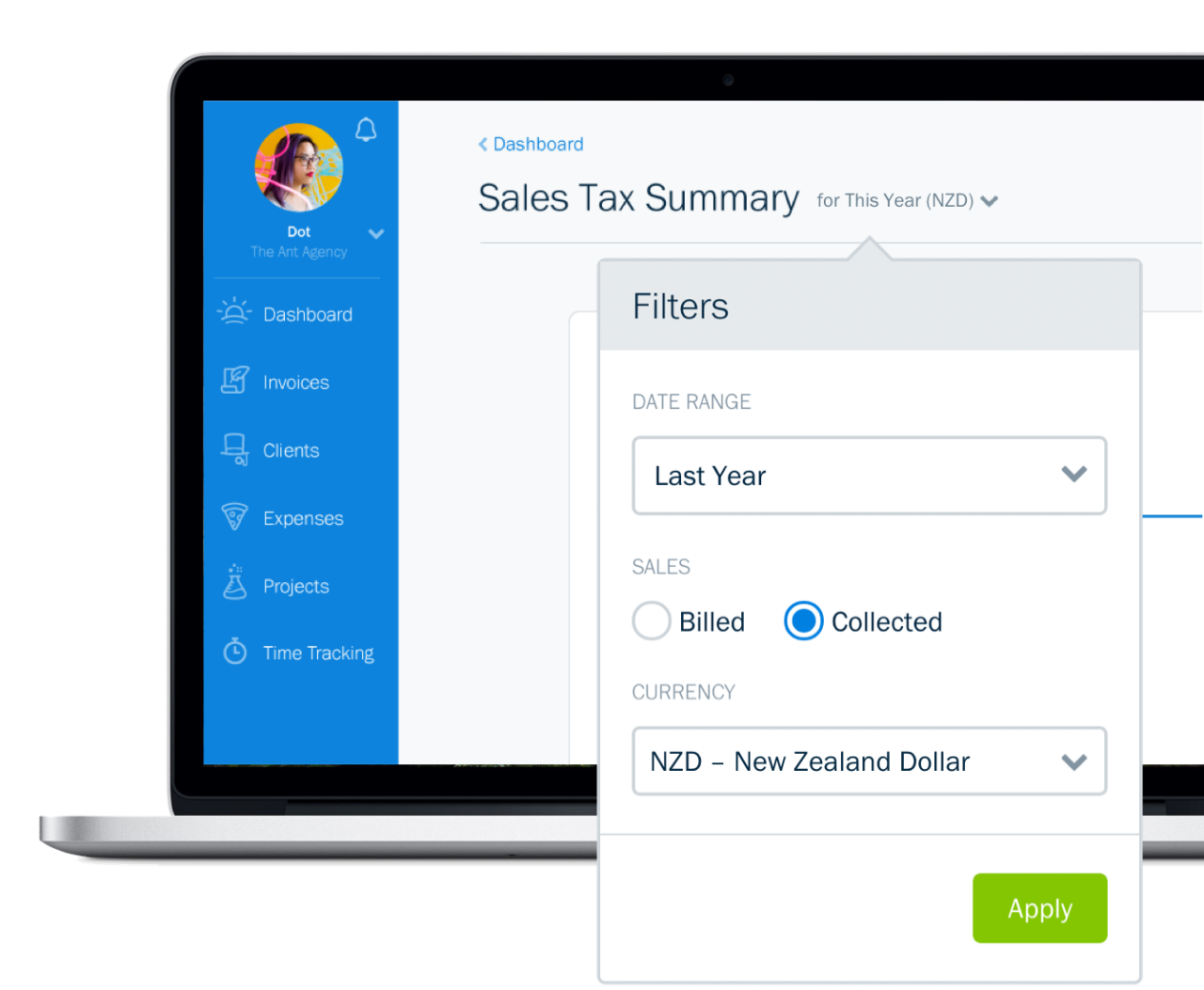

Does FreshBooks have a financial report that can show me how much sales tax I collect and how much I spend?

Yes! The Sales Tax Summary financial statements show you how much you’ve paid in taxes on Expenses over a certain period and how much you’ve collected. In terms of financial reporting, the sales tax report is essential at tax time.

You can run a Sales Tax Summary Report and other financial reports in the Reports section of your FreshBooks financial reporting software account by selecting Sales Tax Summary under Accounting Reports.

Once you’ve generated your tax payments report, you can adjust your view by clicking on Filters under Settings. From here, you can change the Date Range, Sales type (Billed vs Collected), and Currency type.

The top left of your report will show you Total Billed or Total Collected, giving you the total overall value you have either invoiced for or collected during your selected date range.

When you have adjusted your report using the appropriate filters, you can export it to Excel or choose to print it from your cloud-based accounting software.

What is the Cash Flow financial report?

Cash Flow Reports (or cash flow statements) use business analytics and past data to show you exactly how much cash your company has on hand. It also shows you all the money entering (e.g. collecting payment online) and leaving your business (e.g. paying rent or lease bills). This includes any operating expenses, fixed assets, or other expenses that depreciate over time for better expense management.

A Cash Flow Report is one of the three critical financial statements small businesses use to report their financial performance or results over a specific accounting period. The other two crucial financial statements are the Balance Sheet and the Profit & Loss Report (income statement). Using and understanding these reports is an essential part of any business reporting process, and you can create reports in our comprehensive accounting solution.

Get everything you need to know about the cash flow report here.

Get a quick review of generating financial reports in FreshBooks with this short video.

Check out how ridiculously easy to use FreshBooks invoicing is, or learn more about FreshBooks.