Finally, an Expense Tracker Made Simple

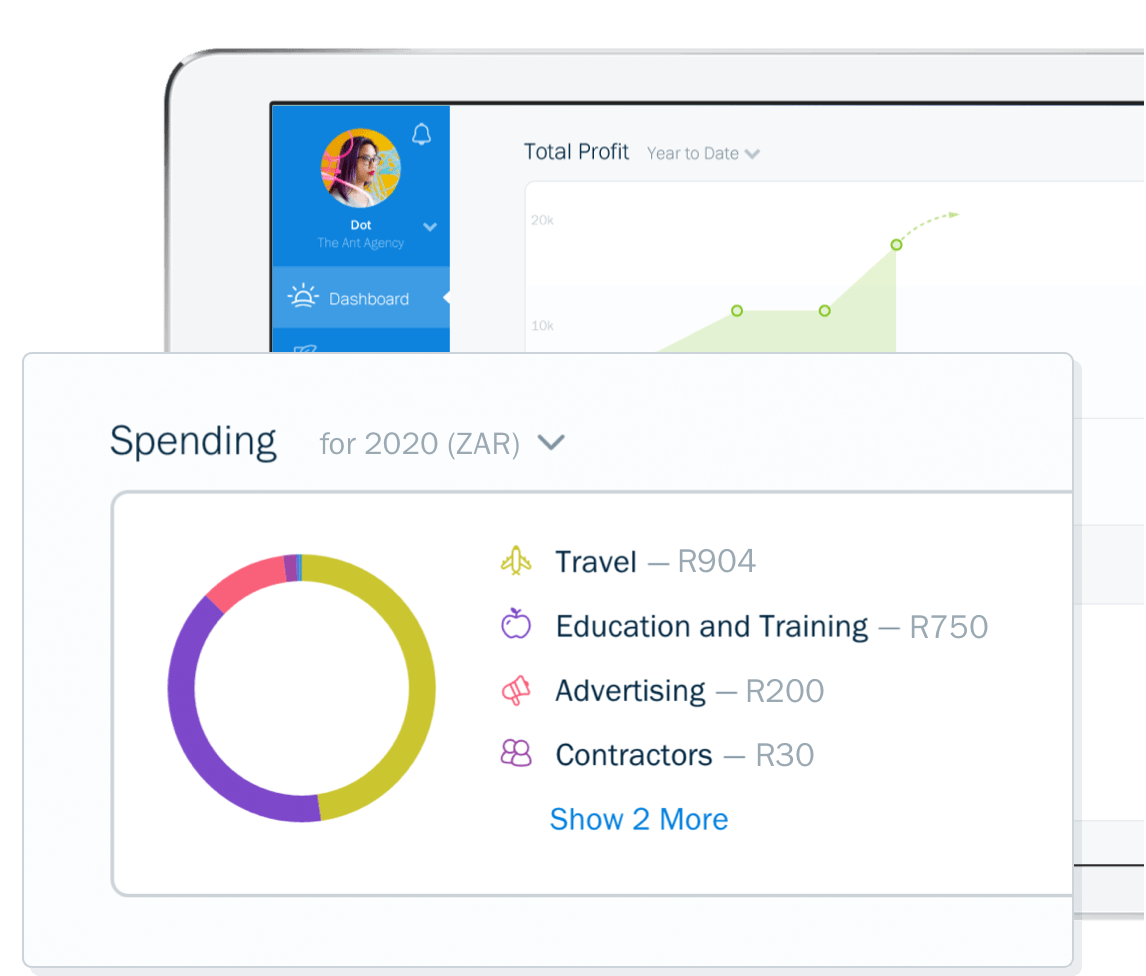

Save money with a powerful and simple expense tracker app that makes tracking your business finances super easy. You’ll know at a glance what you’re spending and how profitable you are, without clunky spreadsheets.

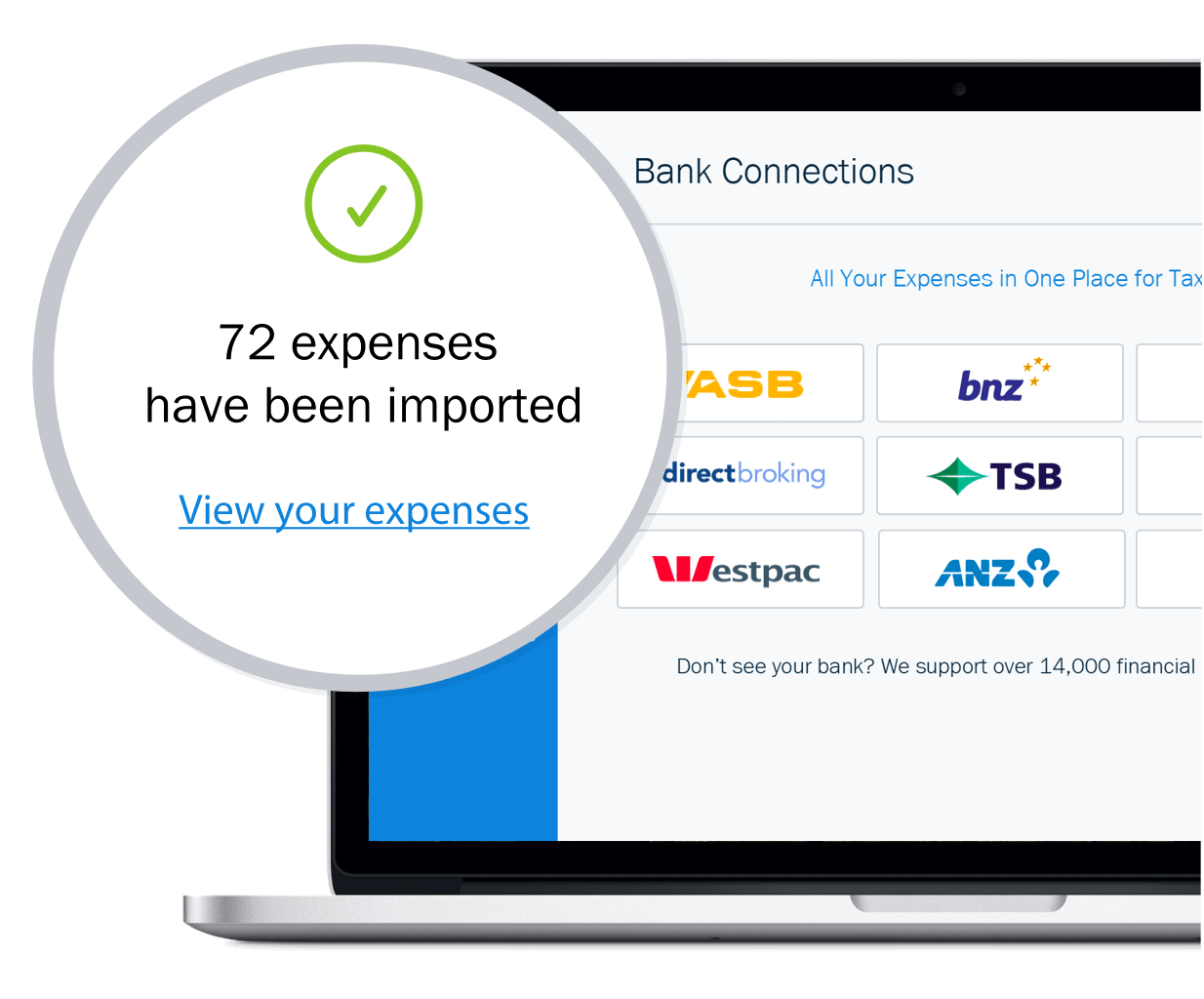

Track Business Expenses Without Lifting a Finger

Connect your bank account or credit card to FreshBooks and say goodbye to manual expense entry. With automatic daily updates, you can track your spending and keep your books current.

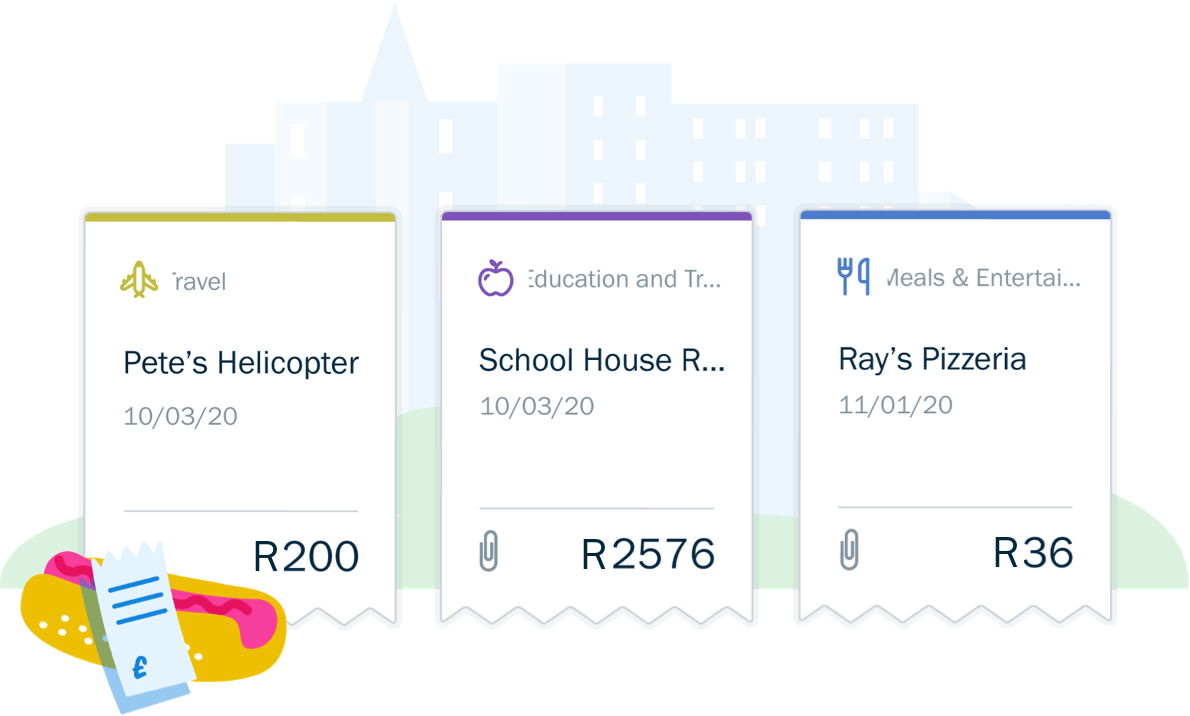

Never Lose Another Receipt

Stop worrying about saving receipts in your expense management system. Snap a picture of a receipt, and let the FreshBooks expense tracker app turn it into a logged expense with all of the receipt details organised in the cloud.

Make Tax Time a Breeze

Expense tracking in the FreshBooks accounting software is made with tax time in mind, so it’s easy for small business owners (and their accountants) to file.

Easily Bill Your Client For Expenses

Forget about leaving money on the table. With the FreshBooks Expense tracker app, you can quickly mark your business expenses as billable, add a markup, and then automatically pull them onto an invoice for your client for a better handle on your monthly cash flow.

Keep Project Spending On Track

Tracking expenses in FreshBooks means your team can keep tabs on how much they’re spending on projects. It also means you can keep a close eye on how things are tracking to budget.

Easy Expense Tracking Continued

Keep better track of how you spend money with these key features:

- Multi-currency expenses

- Auto-categorisation of expenses

- Tax-friendly categories

- Easily-assigned recurring expenses

- Automatic expense import from your bank

- Easily mark expenses to rebill to a client later

- Snap and store pictures of business receipts in the mobile app for Android and iOS devices

- Secure receipt storage in the cloud so account details are always in sync across multiple devices

Did You Know…

why it’s accounting software for businesses with contractors

Award-Winning Customer Support

Help From Start to Finish: Our accounting software Support team is highly knowledgeable and never transfers you to another department

4.8/5.0 Star Reviews: Yup, that’s our Support team approval rating across 120,000+ reviews.

Global Support: We’ve got over 100 Support staff working worldwide.

Book a Demo: Sign up for a live weekly FreshBooks accounting software demo and Q&A.

Frequently Asked Questions

Can I import my expenses from a file or automatically track them?

You can enter expenses by uploading a CSV file or have FreshBooks automatically track expenses by connecting your bank, credit cards, and financial accounts, as FreshBooks is open-banking compliant.

If you want to import your expenses in bulk with a CSV file, just populate your file with the necessary fields. Then select “Import Expenses from a File” from the “More Actions” button in the Expenses section of your FreshBooks account.

You can also connect your bank accounts to your FreshBooks account, so the integrated expense tracker app automatically tracks your expenses. You can read more about how to connect your bank here.

Read more about how to import expenses, or connect your bank to import expense data.

Here’s an easy read about all things expense import – Automatic Expense Import in FreshBooks.

I paid for something on behalf of my client. Is it easy to charge that expense back to them?

Yes! Whether you paid in cash, with a credit card, a debit card, or any other way, the FreshBooks expense tracking app automatically shows you any business expenses you’ve incurred for each client. It also lets you add them to any invoice in just a few clicks, so you don’t have to dip into your personal finances. You can assign expenses to a client or project when they’re incurred, and then you can mark these expenses as billable so that your client will be invoiced for them later.

The financial costs of not rebilling business expenses can add up and negatively impact your financial life. That’s why the best expense tracker apps make it easy to add a customer expense to an invoice and help your cash flow.

Learn more about rebilling an expense.

Number 4 on this list of “10 Advanced Invoicing Tips to Get Paid Even Faster” is all about rebilling expenses and why it’s crucial. Check it out.

Does FreshBooks have any reports that I can use to see how much I’ve spent? Can I use that when I file my taxes?

The best expense tracker apps for small businesses allow you to seamlessly add your expenses to detailed financial reports for your business. FreshBooks offers reports that show all the money flowing in and out of your business, so you know exactly where you stand throughout the expense reporting process.

There’s even a dedicated Expense Report that shows the details of each expense, when you paid for each expense, and how you categorised each expense. Applicable taxes for your business are included in these reports as well.

You can find your Expense Report in the Reports section of your FreshBooks account, under “Invoice & Expense Reports”. You can use the Expense Report when you file your taxes to get a summary of your spending habits throughout the year.

Learn more about the Expense Report.

Read this article to learn more about essential tax time reports: 3 Reports You Can’t Live Without at Tax Time

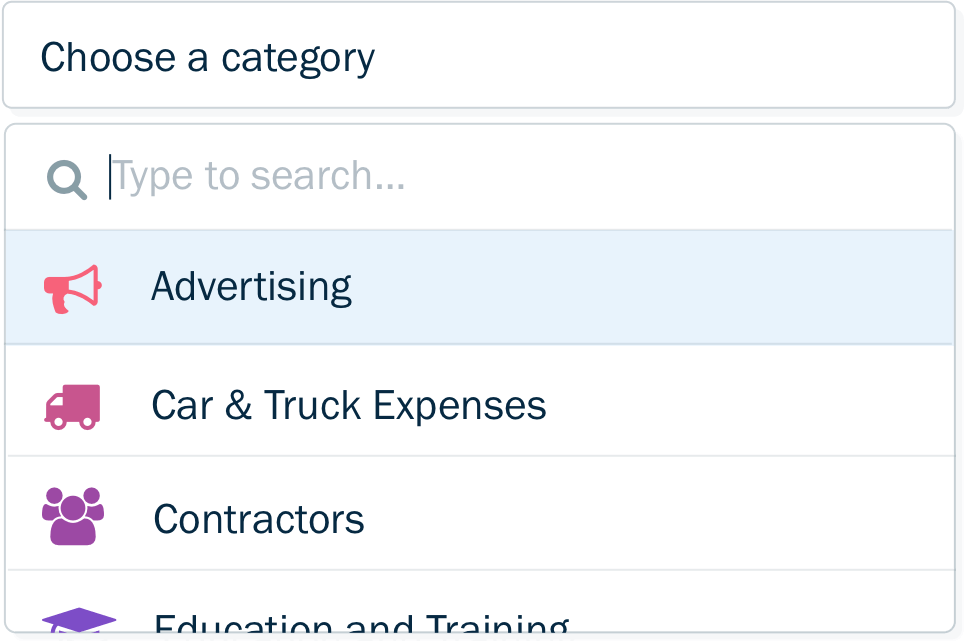

Why should I categorise my expenses?

It’s important to categorise expenses so you can identify what areas of your business you might be overspending on. Group expenses by spending categories to help you maximise your tax deductions and credits at tax time.

FreshBooks expense tracker provides default Expense categories and subcategories for you to choose from. You can categorise your business expenses easily under Advertising, Car & Truck, Employee Benefits, Meals & Entertainment, and more. You can provide even more granularity to your expense reports by using expense subcategories.

Some business expense trackers don’t let you customise your expense reports. However, with FreshBooks, you can create custom expense subcategories specific to your business’s unique needs, expenses and spending habits. You can also create custom expense subcategories in flight while editing a business Expense.

Learn more about expense categories.

Deepen your knowledge about the importance of expense tracking and expense tracker apps with this great article: Why You Should Track Your Business Expenses Daily.

See how FreshBooks helps you seamlessly collaborate with your team and gives you a clear picture of how your business is doing, or learn more about FreshBooks