FreshBooks 2021 Canadian Self-Employment Report

Download the full report here.

From Traditionally-Employed to Entrepreneur: Canada’s Great Transition is Around The Corner

Key Points:

- An estimated 7 million Canadians are expecting to leave their “traditional” jobs in the next two years for self-employment

- The global pandemic has changed the way people work and inspired a new age entrepreneurs

- While Canadians dream of being their own boss, what are the realities and risks at stake?

Introduction

The COVID-19 pandemic has changed the way we work and undoubtedly will continue to influence employment for many years to come. We’re finding more and more employees are working from home or working in a hybrid model with less time in a central office. Women, too, have been affected by the pandemic’s work and life demands, and are opting to leave the workforce to join the growing ranks of self-employed.

This self-employed cohort intrigued us at FreshBooks, and we couldn’t help but look and see if people are really leaving relatively secure, 9 to 5 workplaces for the unknowns of self-employment.

The short answer is: Yes! According to FreshBooks’ research, an astonishing 7 million Canadians are expecting to exit their “traditional” jobs in the next two years for self-employment. Add to this, nearly 2 million others are already supplementing full-time employment with side gigs. Canada’s full-time employment workforce, age 15 and older, is about 30 million—so these numbers are anything but trivial. While we can expect not everyone to make the move to self-employment, these numbers serve as a great indicator of the volume of Canadians who have self-employment on their mind over the next few years.

In 2020, the U.S. saw the highest rate of applications for new businesses since 2008, signalling a major shift in the way we work. Similar data doesn’t currently exist for Canada, so our FreshBooks 2021 Annual Report aims to discover why the paradigm shift is occurring right now.

FreshBooks also wants to uncover what aspiring entrepreneurs expect, and determine those motivating factors leading to self-employment and what might also be holding others back from taking a similar leap.

FreshBooks conducted research for this report in collaboration with Dynata. More than 3,000 people who work full time—either as traditional employees, independent professionals, or small business owners—were surveyed online in August and September of 2021.

The intended takeaway is that while the Great Resignation is ongoing in Canada, there is another seismic shift happening - a Great Transition to self-employment that will continue over the next five years.

Let’s start by looking at how traditionally employed Canadians are planning their leap to self-employment.

Trends in Self-Employment

Clearly, the narrative around self-employment is shifting. We’re going to touch on emerging and influential social trends that play a role, including age, gender, education, race, place of residence, and COVID-19.

According to FreshBooks findings, of the 30 million working Canadians, nearly 7 million are expecting to make the jump to self-employment within the next two years.

Age Factor

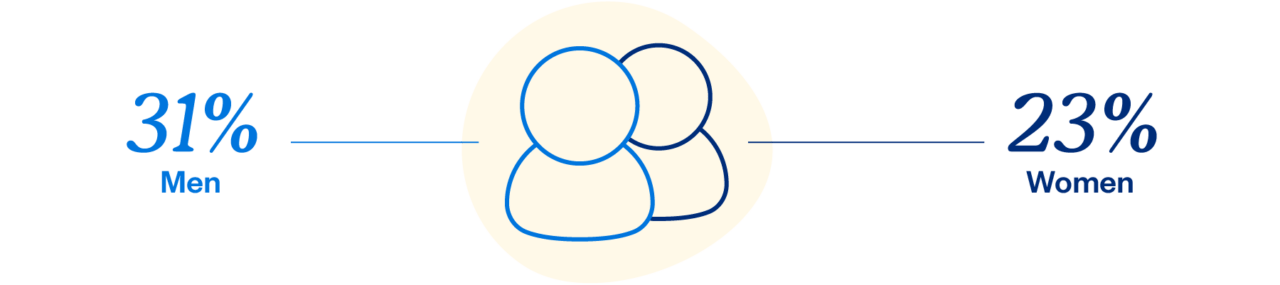

Gender

Another eye-opening trend, in the near term—within two years—the number of men who expect to be self-employed is 31%. The number for women in that same timeframe is 23%.

Education

Education is another factor that influences expectations for self-employment. Those achieving a college degree or higher are more likely to opt for self-employment in the next two to two years.

Visible Minorities

FreshBooks also found that visible minorities have a propensity toward entrepreneurship, with 36% anticipating a move to self-employment in the next two years. This number increases to 46% when looking at expectations to be self employed in the next five years.

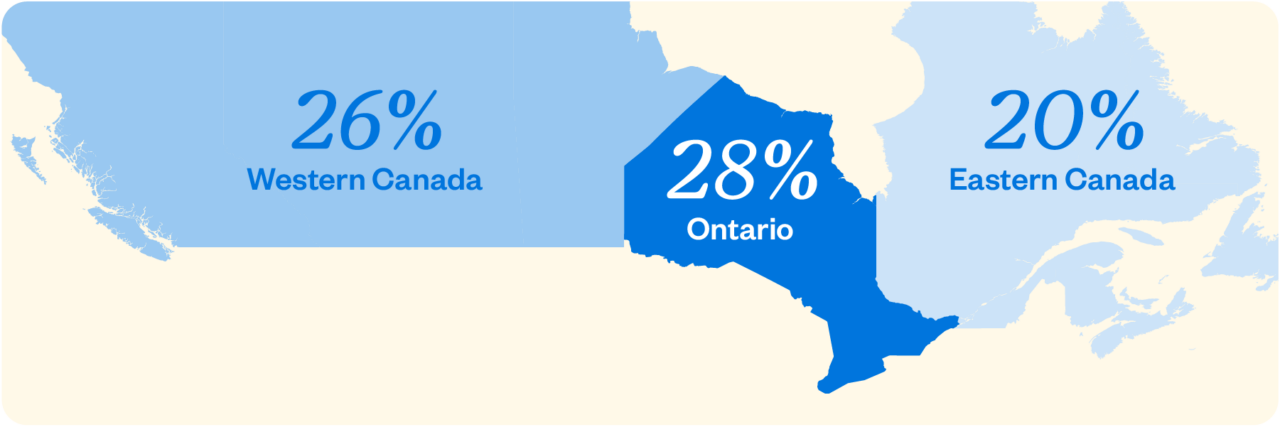

Where Workers Live

Not surprisingly, there are also variations in interest in self-employment based on where people live in Canada. Here is a snapshot of where those saying they will likely be self-employed in the next two years currently reside:

Effects of COVID-19

As you might suspect, the COVID-19 pandemic has been another motivating factor for Canadians considering self-employment. Of those contemplating the move:

Motivations for Self-Employment

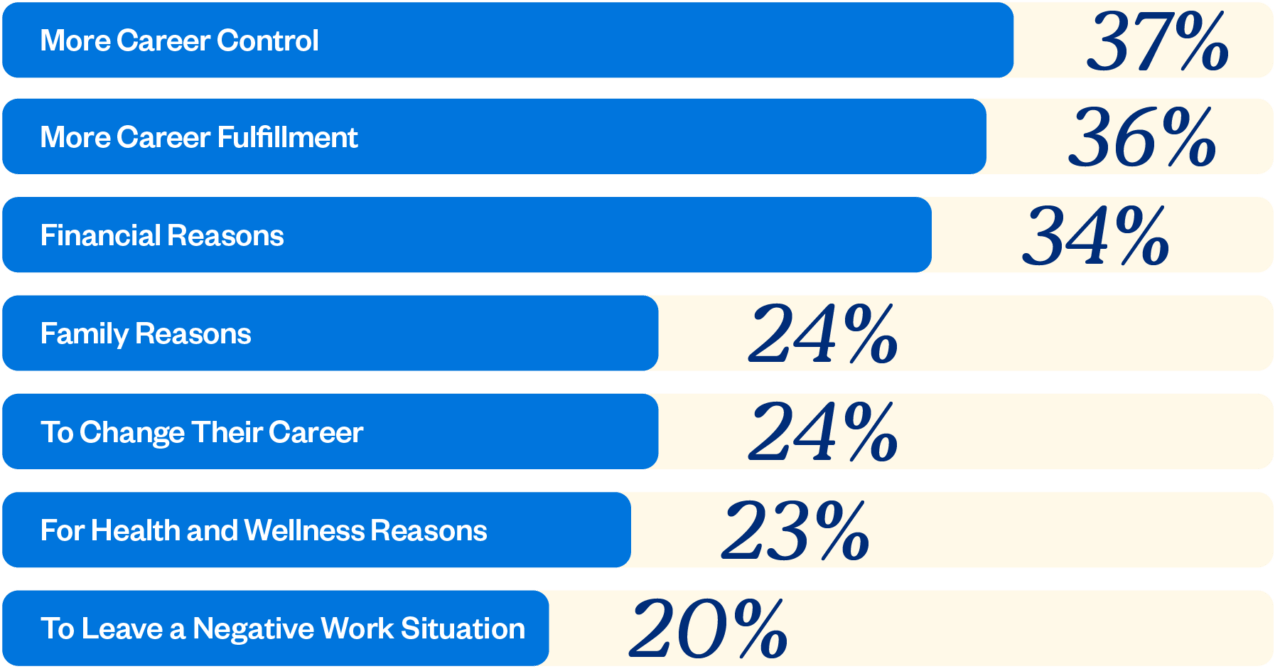

Despite the pandemic’s influence on our approach to work, self-employment is still a preferred choice; 87% of Canadians say they would choose to be self-employed rather than forced into it, and the reasons they noted include:

While these motivations were the top reasons for self-employment, there are some interesting differences between men, women, visible minorities and those over 55 years of age:

- For women, career fulfillment was a key motivator while men cited financial reasons.

- Education is a driver, too, with 28% of respondents with a post-grad degree say they would pursue self-employment for financial reasons versus 22% with a college degree and 17% with no degree.

- Career fulfillment was the main reason to pursue self-employment for visible minorities while Caucasians felt career control was most important.

- For those over 55 years of age, 32% of respondents say self-employment was an effort to try something new, noting they would work in a vastly different field than the one in which they were traditionally employed. As a comparison, only 18% of those under 35, and 21% of those 35-55, were looking to try something new.

What’s Holding Them Back?

While many people want to make the jump to self-employment, only a fraction actually become self-employed. Why the gap from intent to follow-through?

Here are some of the key insights:

Benefits and Healthcare

Lack of employment benefits was cited as an important consideration for maintaining traditional employment:

Cash Flow

40% of all would-be entrepreneurs noted inconsistent income as the number one concern in considering self-employment.

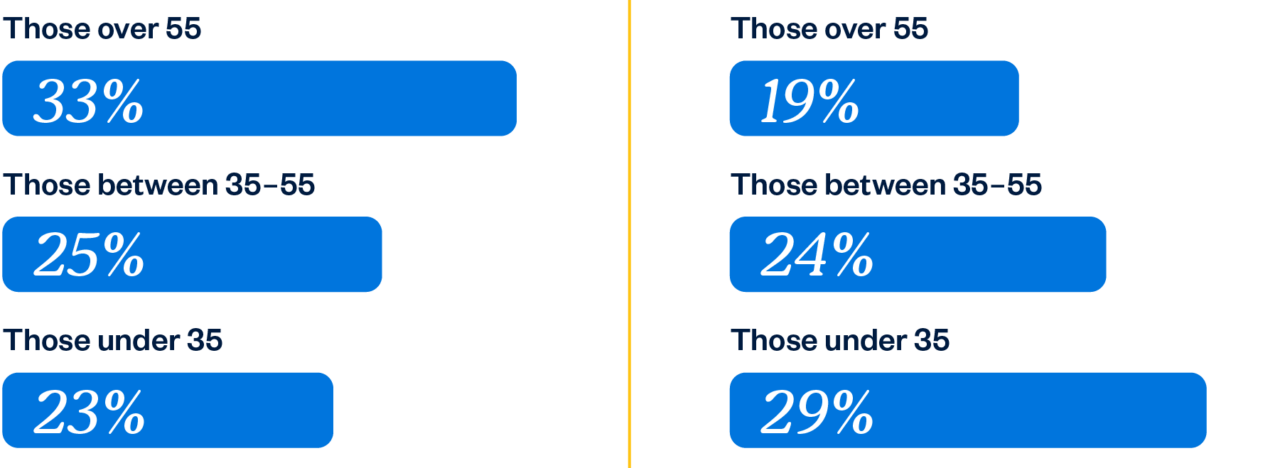

Lack of Capital

Access to funds is one of the biggest barriers to self-employment with many noting they simply don’t have the money to make the investment needed or are already faced with heavy debt burdens. Here is how this lack of capital breaks down by age:

- 29% of those under 35

- 24% of those 35-55 years old

- 19% of those 55 and over

Snapshot of the Self-Employed

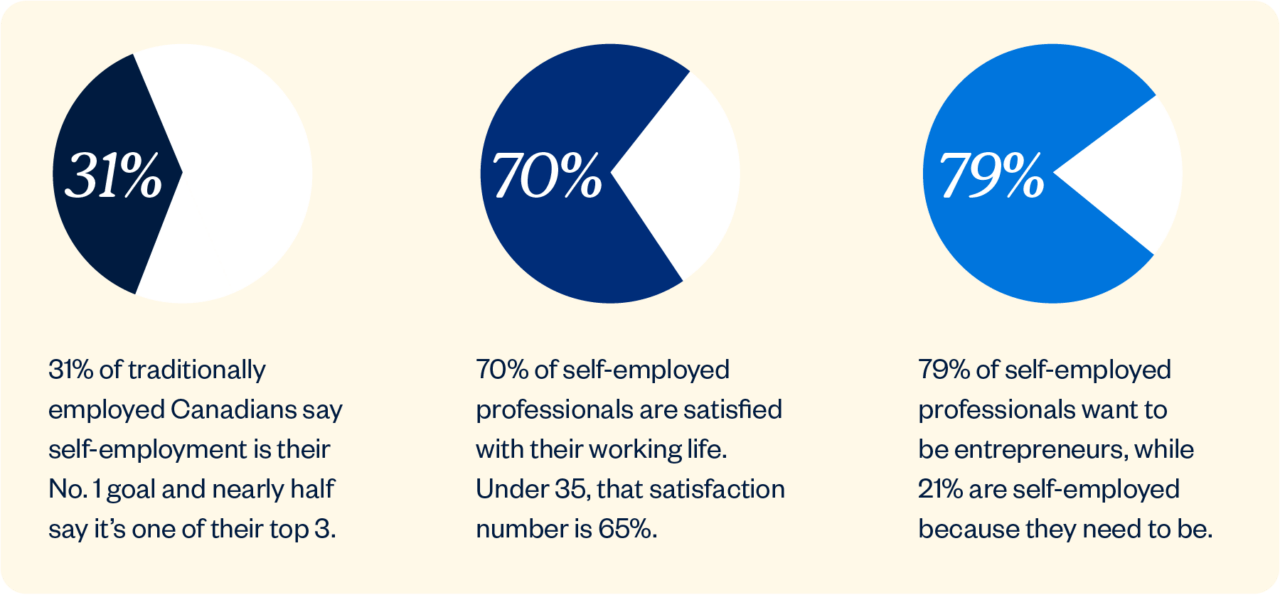

Self-employment is definitely a dream for many Canadians and those who have made the transition to self-employment are happy about their decision.

Vacations

Still, there are obstacles for entrepreneurs, although they are not necessarily only the problems of the self-employed. FreshBooks found that about a third of business owners felt too busy to take a vacation and had difficulty deciding when to take time off. This rate increases coincidentally with revenue. Men and entrepreneurs under age 35 are more likely to forego vacation time.

Finances

Finances were a stressor for 42% of business owners and this number is higher with women and younger entrepreneurs.

Retirement

Retirement is also problematic for many self-employed. Only 56% of those business owners aged 65 and older felt they were on track to retire with. In addition, 38% of all self-employed respondents say they plan to work beyond 65 to make ends meet. This rates even higher for women.

Benefits

One of the most noted barriers for making a move to self-employment is giving up the trappings of traditional employment—benefits, insurance, and a steady paycheque.

Women and the Workforce

Global research and our own COVID-19 Women’s Report clearly show that women, both self-employed and traditionally employed, had a difficult experience through the pandemic and rolling lockdowns. Women were far more likely than men to leave the workforce to care for children or elderly care.

But women are still interested in taking the leap, indicating a desire to pursue self-employment to seek more career fulfillment (41% compared to 33% for men) or to leave a negative work situation (24% compared to 17% for men).

Even with these motivating factors, women face multiple barriers and obstacles to self-employment, and these include:

Women are less likely to see self-employment as their number one goal—27%, where 34% of men state this as their top goal. For many women, self-employment is a chance to do something completely different from their traditional job—30%, whereas for men this number is 18%.

In fact, 82% of women say they are very satisfied with their decision to be an entrepreneur.

The COVID-19 pandemic affected working women disproportionately. More than a third—42%—were expected to take on additional household responsibilities and a full third paused or otherwise put off work-related responsibilities. This was noted particularly in women aged 35-49 and those in business for two to five years.

Conclusion

Every year, millions of people leave the stability and security of traditional employment for what they hope will be the greener pastures of self-employment. There is no doubt that those who make the leap are largely satisfied but the path to feeling secure is a journey.

The pandemic has placed more value on the flexibility and control offered by self-employment, especially when it comes to managing other household responsibilities like childcare. We’re convinced the trend of people leaving traditional employment will continue, but the struggles of financial stress, making time for vacations and planning for retirement are constant.

Where to next? Numbers of self-employed are expected to rise with the Great Resignation in the next five years. There is a real opportunity to improve the experience of the self-employed with business support and entrepreneurial financial services tailored to this growing contingent of working Canadians.

Survey Methodology

FreshBooks conducted research for this report in collaboration with Dynata. More than 3,000 people who work full-time—either as traditional employees, independent professionals, or small business owners—were surveyed online in August and September 2021. Samples have been weighted (as required) to reflect various characteristics of target populations (e.g., age, gender, and industry), leveraging data from Statistics Canada, the NAICS Association, and other sources. The study’s margin of error is +/- 2.5% at 95% confidence.

About FreshBooks

FreshBooks is changing the way business owners manage their books. Its owner-first accounting platform, loved by businesses in over 160 countries, takes an easy-to-use approach to managing finances, billing, payments, and client engagement. FreshBooks, known for its 10x Stevie award winning customer support, serves customers of all sizes from offices in Canada, Croatia, Mexico, Germany, Netherlands, and the US.

PR Contact:

Megan Shay

FreshBooks

[email protected]

Share: