You can now track your mileage, categorize business trips, and view your tax deduction—all from your phone, using Mileage Tracking.

If you drive a car for work, you can maximize your tax deduction by claiming the mileage.

But keeping track of your travel on-the-go can be a huge hassle. Between logbooks, gas station receipts, and remembering which trips are actually work-related, it’s easy to lose track of what you can and can’t claim on your taxes.

To help, FreshBooks created the new Mileage Tracking feature. Now, you can automatically track your mileage as you drive, easily categorize trips as business-related, and see your potential tax deduction – all from the FreshBooks mobile app.

What Is Mileage Tracking?

Mileage Tracking is a new feature on the FreshBooks mobile app that lets you track your mileage, categorize each trip, and view your potential tax deduction.

Where Is the Mileage Tracking Feature?

You can find Mileage Tracking within the FreshBooks iOS app or FreshBooks Android app, under the More button in the bottom right of the navigation menu:

How Do I Track My Mileage?

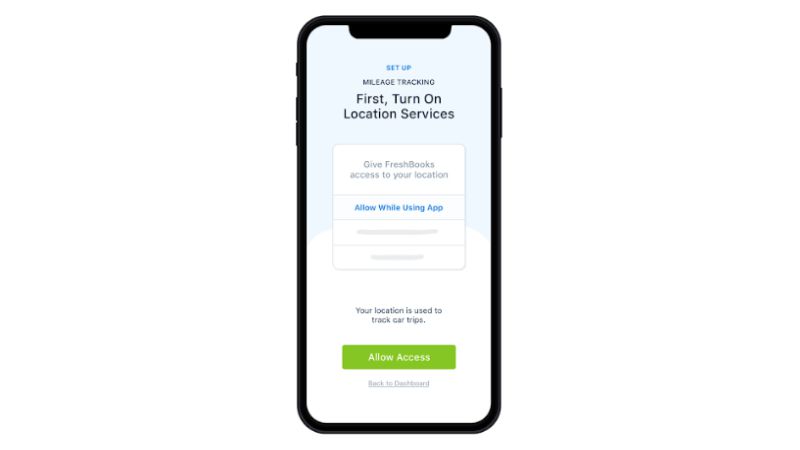

When you first open the Mileage Tracking feature, you’ll be prompted to complete a quick setup. Once complete, the app will recognize when you’re driving and automatically track your mileage. It’s simple and hands-off, so you can focus on the road. Here’s what the setup screen looks like:

How Do I Categorize My Trips?

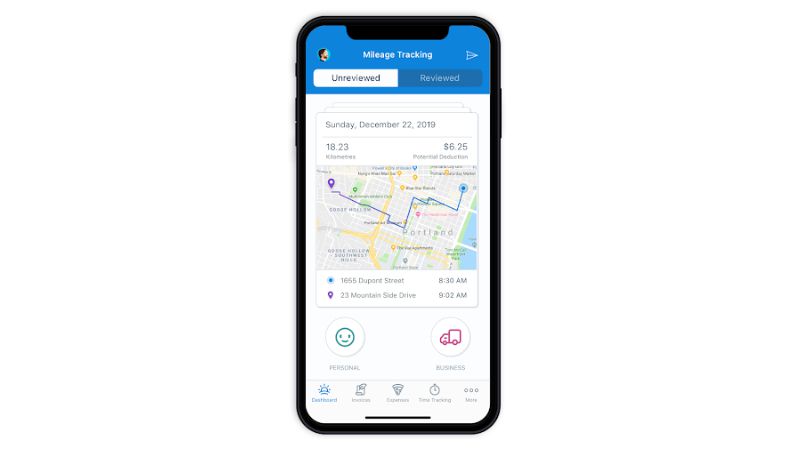

You’ll be periodically asked to review any trips the app has tracked for you. Simply swipe left to categorize a trip as Personal or right to categorize it as Business. Here’s what the review screen looks like:

What Mileage Can I Claim for My Business?

Simply put, if it’s for work it’s deductible. Making a sales call, driving to a client presentation, even visiting the post office to send a shipment to a customer can count toward your tax deduction.

Just remember that the trip has to be for work. So, you can track the 20 minutes to and from a sales call. But if you stop for a slice of pizza on the way back, that extra mileage doesn’t count.

How Do I See My Tax Deduction?

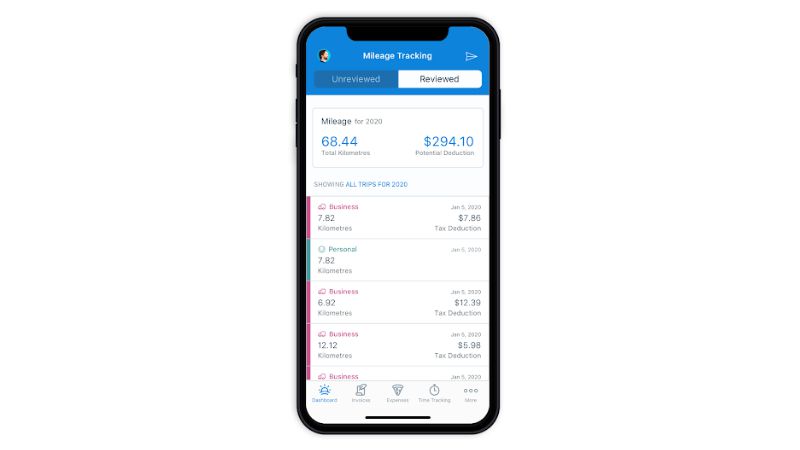

Once you categorize a trip in-app, it’s sent to your Reviewed tab. At the top of this page, you’ll see a section that shows your total distance tracked, as well as your Potential Deduction. Here’s an example:

What Else Can I Do With Mileage Tracking?

You can easily generate a Mileage Log Report and email it directly from the app by clicking on the paper plane icon in the top right corner of the Mileage Tracking page. This report is also in your FreshBooks account under the Reports section, and shows you all potential deductible mileage at tax time.

Things to Keep in Mind

It’s important to remember that the Mileage Tracking feature can only show you a potential tax deduction. It’s the best estimate the app can provide based on your mileage tracked, but may not be 100% in line with what the government will actually reimburse you!

If You Need Help, FreshBooks Is Here

If you have any questions on how to use Mileage Tracking or feedback on how it can be improved, feel free to reach out here.

And when you’re ready to use Mileage Tracking? Jump into the iOS app or Android app to check it out!

about the author

Dave is a Senior Copywriter currently working for FreshBooks, serving all the amazing businesses using the platform. When he’s not writing, Dave can likely be found binging Netflix alongside his dog Indy.